AccordingtotheintroductionofSawhneySystems,TaxMode:incometaxcalculator&plannerforUSAisaFinanceappontheAndroidplatform.Thereiscurrentlya2020.4versionreleasedonJan04,2020,youcanseethedetailsbelow.

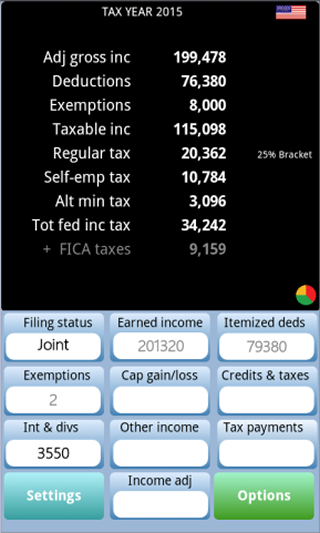

INCOMETAXCALCULATOR&PLANNERThisprofessionalgradeUSAtaxplannerisdesignedtosatisfytheadvancedtaxcomputationneedsofafinancialplannerandyetitissimpleenoughtobeusedforaquicktaxcalculationbyacasualuser.

KEYACTIVEFEATURES

●Updatedfor2020and2019taxyears

●IncludesQualifiedBusinesspass-thruthresholdanddeductions

●Includestaxyears2020,2019&2018

-Regularincometax

-Self-employmenttax

-QualifiedBusinessincomededuction

-Netinvestmentincometax

-AdditionalMedicaretax

-Itemizeddeductionswiththreshold&phase-out

-Personalexemptionswiththreshold&phase-out

-ChildandDependentTaxCredit

-EarnedIncomeCreditcalculations

-Alternativeminimumtax

-Lump-sumdistributiontax

-FICAtaxes

●QuarterlyEstimatedTaxcomputations,report&IRS1040ESformsupport*

●Automaticselectionofapplicabletaxcomputations

●AutomaticcheckforAMTapplicabilityandanalysis

●ComputesEarnedIncomeCredit

●Verifytheadequacyofestimatedtaxpayments

●Analyzeimpactofspecificdeductions

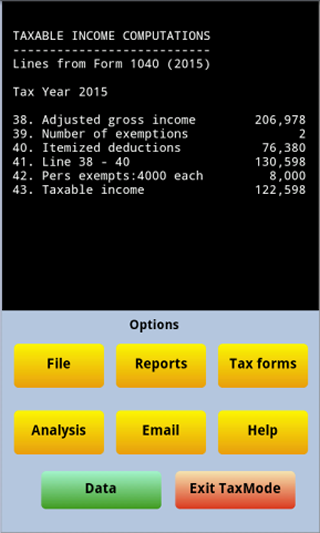

●SupportedwithdetailsintermsofIRStaxforms*

●Summaryordetaileddataentryoptions*

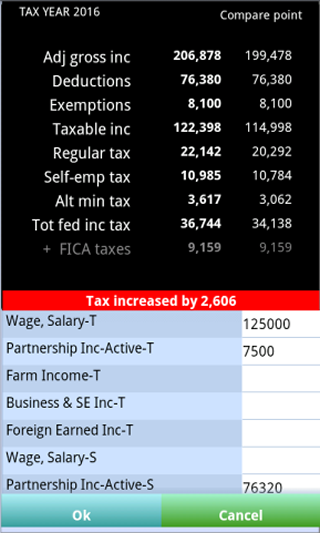

●Sidebysidecomparisonofalternativescenariosforwhat-ifanalysis*

●Effectivetoolforpre-taxreturnanalysis

●Abilitytoemailreports*

●Enhanceddataentry*

●Abilitytoload&saveplans*

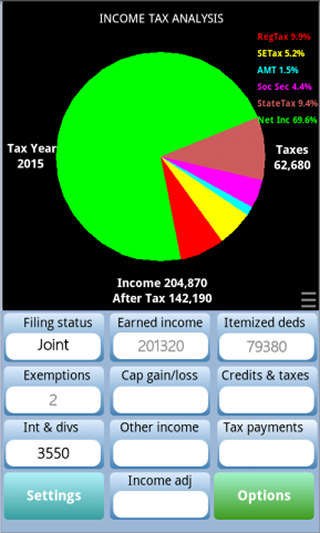

●Piechart&multiplereports*

●Automaticlimitationofmaximumamountsallowedfor-

-Medicalexpenses

-Investmentinterestdeduction

-Charitablecontributionswithdeductiontestsfor60%,30%&20%qualifiedcontributions

-Unreimbursedbusinessexpenses

-Casualty&theftlosses

-Studentloaninterestdeduction

-Tuition&feesdeduction

TaxModeisaquickandefficientappforincometaxplanning.Itprovidesaneasywaytocomputetaxesandperformwhat-ifanalysis.ItcontainsdetailedimplementationofthelatestUStaxlaws.TaxMode’scapabilitiescansatisfyalmostanylevelofneedfortaxcomputation,planningandanalysis.

Thisappcanbeavaluabletoolforprofessionalsandnonprofessionalsalike.Forataxprofessionalitwillenhanceyouranalyticalability,improveyourdaytodayproductivityandmaketaxplanningmoreefficient.Foranindependentindividual,itprovidesaneasytousetooltoanalyzethetaximpactofatransactionintermsoftaxessavedorincreaseintaxliability,calculateaquickyear-endtaxestimate,performapre-tax-return-filinganalysis,orreviewtheimpactofanyothertaxrelatedinvestmentdecision;

TaxModecanbeusedwithconfidence.ItiscreatedandsupportedbySawhneySystems,aleadingdeveloperofpersonalfinancialandtaxplanningsoftware.AtSawhneywehavebeenprovidingsoftwareandrelatedsupportservicestothefinancialplanningprofessionalssince1976.OurleadingsoftwarepackageExecPlan(www.execplan.com)wasthefirstintegratedfinancialplanningsoftwareavailablecommerciallyinUSAandthemostwidelyusedprofessionalsoftwareoverpastthreedecades.PlanMode(www.planmode.com)isourlatestfinancialplanningsoftwaredesignedtobeacrossoverproducttofulfilldiverseplanningneedsofaprofessionalplanneraswellasamotivatedindividualinvolvedinretirementorcomprehensivefinancialandtaxplanningonmobileplatforms.

WehopeyouhaveaproductiveandsatisfyingexperiencewiththisappanddelightusbyreviewingTaxModeProatGooglePlay.

PleaseletusknowanythoughtsorsuggestionsyoumayhavewhileusingTaxModethatwillhelpusimproveitsfunctionality.Similarly,pleasewriteusatsupport@sawhney.comifyoudiscoveracomputationalerrororhavequestionsonaspecificcalculation.Thankyou.

*Indicatespremiumfunctions